Maximize Your Travel Spending Plan: Currency Exchange in Toronto Explored

Maximize Your Travel Spending Plan: Currency Exchange in Toronto Explored

Blog Article

Discover the Keys to Making Smart Decisions in Currency Exchange Trading

In the busy globe of currency exchange trading, the capacity to make enlightened choices can be the distinction in between success and failure. As investors browse the intricacies of the market, they frequently look for out evasive secrets that can provide them an edge. Comprehending market fads, executing efficient risk management methods, and assessing the interplay between technological and fundamental aspects are just a few components that add to making smart decisions in this field. There are much deeper layers to explore, consisting of the psychology behind trading decisions and the application of sophisticated trading tools. By peeling back the layers of this elaborate landscape, investors may uncover concealed understandings that could possibly change their technique to currency exchange trading.

Recognizing Market Fads

A comprehensive understanding of market fads is important for effective currency exchange trading. Market trends refer to the general instructions in which the market is moving over time. By comprehending these fads, traders can make even more educated choices concerning when to acquire or offer money, inevitably optimizing their profits and lessening potential losses.

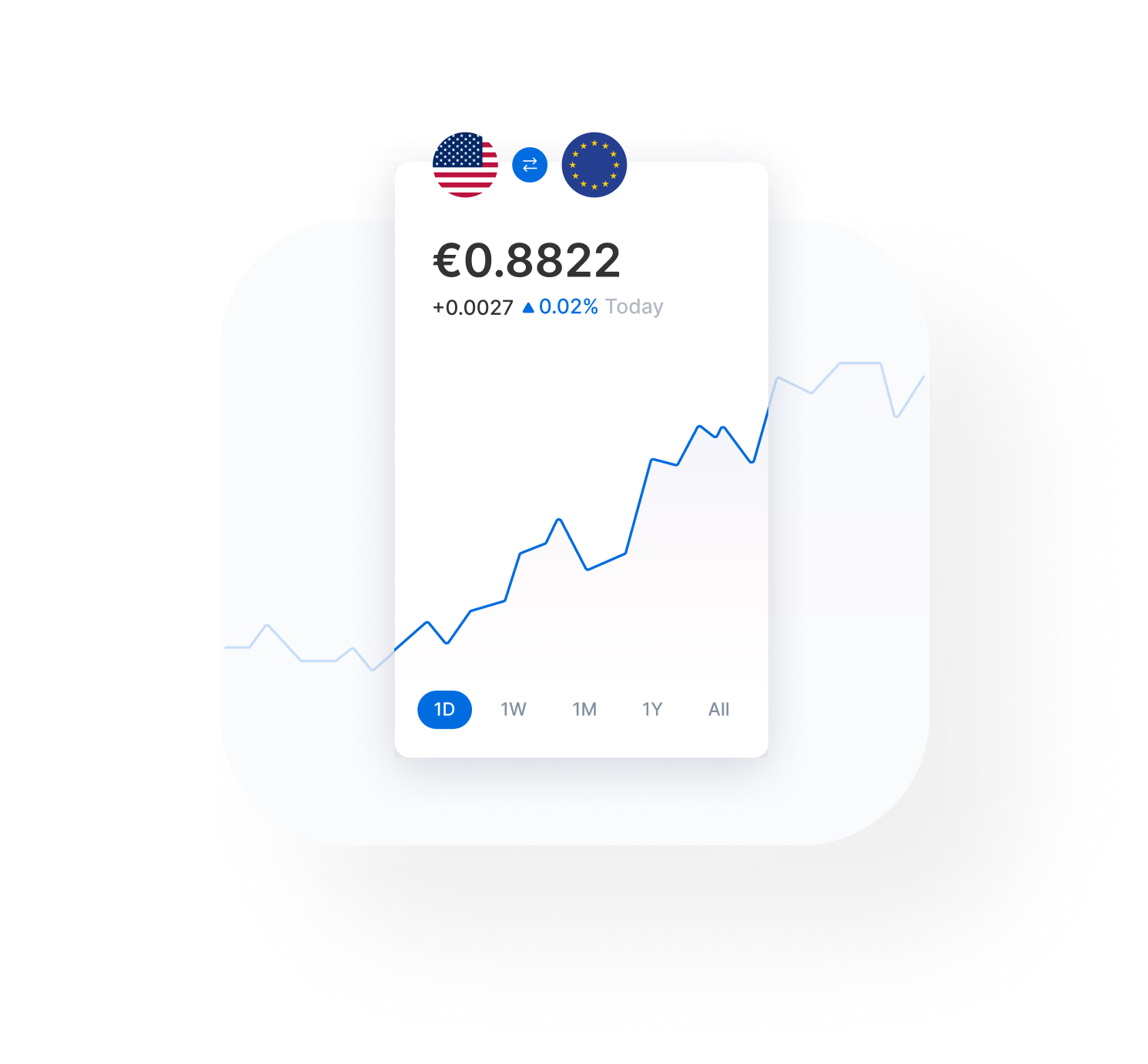

To successfully examine market trends, investors commonly use technological evaluation, which involves researching historic cost graphes and making use of numerous indicators to anticipate future cost activities. currency exchange in toronto. Essential evaluation is also important, as it entails assessing financial signs, political occasions, and other elements that can affect money worths

Danger Monitoring Methods

Just how can currency exchange investors successfully reduce prospective threats while optimizing their investment chances? One crucial method is setting stop-loss orders to restrict losses in case the market relocates versus an investor's position. By defining the optimal loss they are prepared to birth ahead of time, traders can secure their funding from substantial downturns.

Moreover, leveraging devices like hedging can even more protect traders from negative market activities. Hedging entails opening a position to offset potential losses in an additional placement, therefore lessening general threat. Following economic indications, geopolitical events, and market belief is also critical for making notified choices and adjusting techniques accordingly. Inevitably, a computed and self-displined method to risk monitoring is vital for lasting success in money exchange trading.

Basic Vs. Technical Evaluation

The dispute between technological and fundamental evaluation has actually been continuous in the trading neighborhood. Some traders prefer essential analysis for its focus on macroeconomic factors that drive money worths, while others prefer technical evaluation for its emphasis on rate trends and patterns. In truth, effective traders commonly make use of a mix of both techniques to obtain a thorough sight of the marketplace. By incorporating fundamental and technical analysis, traders can make even more informed like it decisions and improve their overall trading efficiency.

Leveraging Trading Devices

With a solid structure in technical and fundamental evaluation, currency exchange investors can substantially boost their decision-making process by leveraging different trading devices. These devices are created to give investors with useful insights right into market patterns, rate motions, and potential entry or departure points. One vital trading tool is the financial calendar, which assists investors track important economic occasions and announcements that can influence money values. By staying informed regarding key financial indications such as rate of interest, GDP reports, and employment figures, traders can make more informed decisions concerning their professions.

Psychology of Trading

Understanding the psychological aspects of trading is necessary for currency exchange traders to navigate the psychological challenges and predispositions that can impact their decision-making procedure. It is essential for traders to grow emotional self-control and keep a logical strategy to trading.

One common mental trap that investors come under is confirmation predisposition, where they seek details that supports their preconceived ideas while ignoring inconsistent proof. This can prevent their ability to adapt to altering market problems and make knowledgeable choices. Additionally, the anxiety of losing out (FOMO) can drive investors to enter professions impulsively, without Source conducting proper research or analysis.

Conclusion

Finally, mastering the art of money exchange trading needs a deep understanding of market trends, effective risk administration strategies, expertise of essential and technological analysis, application of trading tools, and recognition of the psychology of trading (currency exchange in toronto). By combining these elements, traders can make informed choices and raise their chances of success in the volatile world of money trading

By peeling off back the layers of this detailed landscape, traders might reveal covert understandings that could possibly transform their technique to currency exchange trading.

With a solid foundation in fundamental and technological evaluation, money exchange investors can dramatically improve their decision-making procedure by leveraging different trading tools. One necessary trading tool is the economic schedule, which assists traders track crucial financial occasions and statements that might impact currency values. By leveraging these trading devices in combination with technological and essential evaluation, money exchange traders can make smarter and more tactical trading decisions in the vibrant foreign exchange market.

Recognizing the emotional aspects of trading is essential for currency exchange traders to navigate the psychological obstacles and prejudices that can impact their decision-making procedure.

Report this page